Have you ever wondered why most expert advisors are not effective in live trading, despite their perfect backtest performance?

The most likely answer is Over-fitting. Many EAs are created to ‘learn’ and adapt perfectly to the available historical data, but they fail to predict the future due to a lack of generalizability in the constructed model.

Some developers simply don't know about the existence of over-fitting, or they know but don't have a way to prevent it. Others exploit it as a tool to beautify their backtest results, they add dozens of input parameters without considering statistical significance, making the trading strategy excessively tailored to historical data and attempting to convince others that their EA can achieve similar performance in the future.

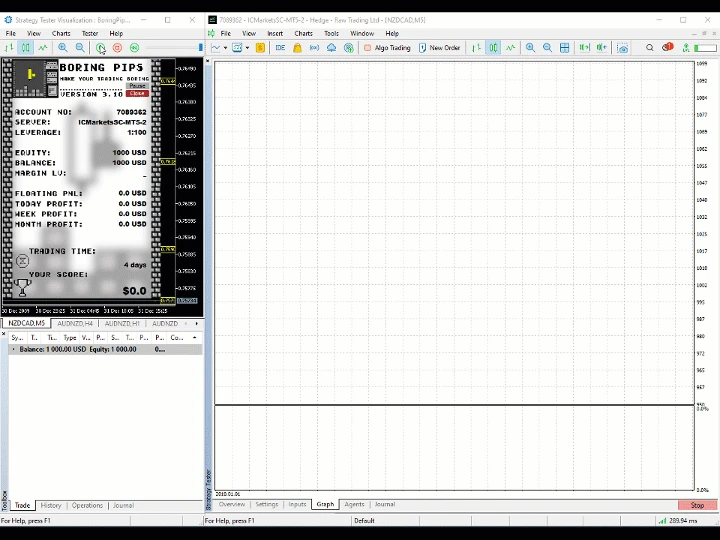

Boring Pips optimization process - A rigorous validation process that creates a difference.

Boring Pips undergoes a comprehensive and tailor-made optimization process called Anti-overfitting. This is a robust optimization process implemented to eliminate any influence of overfitting on the trading system, ensuring the generality of the constructed model. Please refer to the article linked in Part 2 above for a more in-depth look at this process.

Anti-overfitting process consists of 3 stages:

- Initial Optimization: This stage involves optimizing the Boring Pips using historical data from 2010 to 2019. The purpose of this phase is to test the initial premise of the trading strategy and extract the most robust parameters values.

- Walk-forward: In the second stage, the parameters that performed well in the first stage are tested using entirely new data ranging from 2019 to 2022. The objective is to ensure the trading system's stability with fresh data and evaluate the predictive power of the model.

- Stress testing: Parameter values that pass the first two stages will undergo Stress testing. In this final test, a simulation algorithm is used to introduce variables like Noise and Lag to the initial entry and exit points (determined by the selected parameters from Walk-forward phase). The goal is to push the system beyond its 'comfort zone' and assess the system's tolerance to random factors such as lag and noise.